Welcome to the Alabama Commercial Real Estate Index™ (AL CREI™). The AL CREI™ measures commercial real estate expectations for the upcoming quarter gathered from a broad group of professionals working in commercial real estate and related fields. Eight key indicators create a composite index of overall market conditions and an outlook for specific property types. Through the survey, panelists can take the pulse of the state’s commercial real estate market as well as compare their own forecasts to those of their peers.

Click the “Register for the Survey” button below to register as a Residential Real Estate Index (RREI) panelist. Once registered, you will receive an email once a quarter to participate. If you are a returning participant, you do not need to re-register.

For any questions regarding the survey, please contact Stuart Norton at tsnorton@ua.edu or (205) 348-5416.

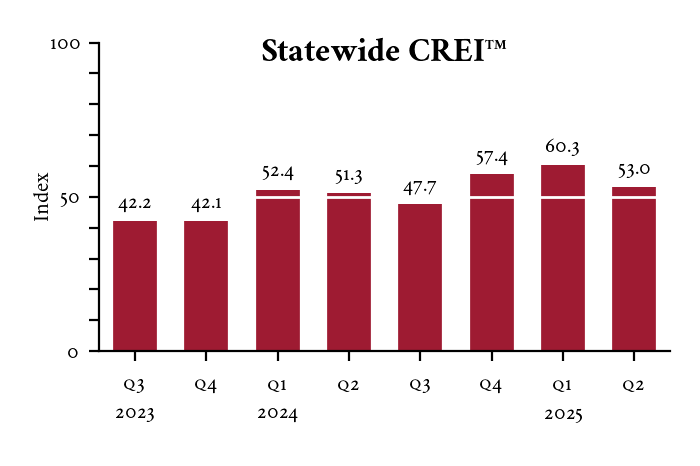

The Alabama Commercial Real Estate Index™ (AL CREI™) is a quarterly survey of commercial brokers, developers, property managers, investors/owners, lenders, and other industry professionals to measure market expectations for the upcoming quarter. An index value of 50 indicates a neutral outlook. Scores below 50 indicate contractionary outlook while scores above 50 indicate an expansionary outlook.

In the Alabama Center for Real Estate’s survey, responses from the Q2 2025 CREI™ registered an index of 53.0. This means commercial real estate professionals across the state expressed mild confidence that the statewide CRE market will expand (improve) during the second quarter. However, the Q2 index is 7.3 points below the Q1 CREI™, indicating a continuation of last quarter’s expansionary forecast, but with a lower level of confidence.

All four components of the CREI™ decreased from Q1 2025. The index for interest rates showed the largest decrease, falling 10.6 points from the prior quarter. However, interest rates are still expected to decrease in Q2, but with a lower level of confidence. Construction costs were the only component of the index with a score below 50. The Q2 index decreased 3.4 points from Q1, registering a score of 38.4, meaning construction costs are expected to rise again in the near term. The Alabama market outlook decreased 8.6 points, and the US market outlook decreased 6.5 points, displaying an expectation of improving market conditions but with a lower level of confidence than in Q1.

This website uses cookies to collect information to improve your browsing experience. Please review our Privacy Statement for more information.