While valuation uncertainty rises during peaks and troughs to market cycles, lenders and investors still struggle to define the new normal and where (market, property type and price point) it is safe to re-enter the market as there is less transaction activity and transparency to redefine the value trends. This situation became most apparent this week when the Pension Real Estate Assoc. (PREA) reported that it is seeing reduced CRE investment activity by 70% of pension fund investors as they struggle over the value of commercial real estate assets. This is a material issue for pension funds and institutional investors in CRE because quarterly these funds are required to mark their portfolio assets to market value – and then rebalance their CRE investment allocations. These pension funds include the likes of the California State Teachers Retirement System (CalSTERS) and various state retirement systems, such as a Retirement System of Alabama (RSA).

While most funds opted to keep CRE values relatively unchanged at the end of Q1 2020 due to a dearth of COVID-19 impacted economic, market, or property level data, updated economic data noting 22.4% unemployment (U6 BLS rate reflecting Total Unemployment), 16.4% decline in April Retail Sales, negative 4.9% GDP, and nearly 8% of all home loans in some sort of loan forbearance (<1% is the historic norm), etc. suggest valuations cannot go unchanged at the end of Q2 2020. The question now becomes “What will those refreshed valuations look like, and how big of an adjustment will pension funds undertake?” The end of June value adjustments will likely alter pension fund CRE investment activity in the second-half of 2020. Institutional investors’ appetite for CRE is not insignificant. It accounts for trillions of dollars of investment in the sector each year. In 2018, for instance, the 500 largest institutional investors allocated $2.53 trillion to real estate investment, according to the pension fund data tracking firm Preqin.

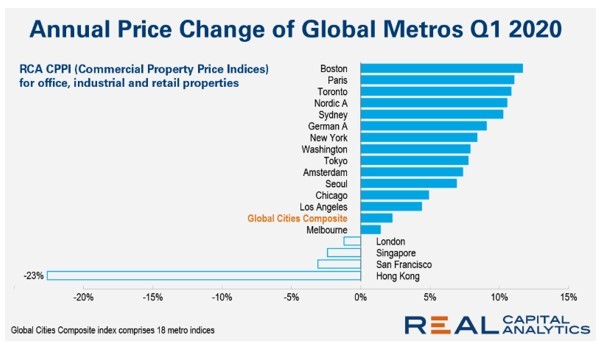

Aside from the $2.5 trillion of CRE investment activity by pension funds, there are two other important dimensions to this week’s news by PREA impacting commercial real estate. First, the anticipated pull back in CRE transaction activity from PREA is a valuation issue – and not a lack of interest in the asset class. In a zero percent interest rate environment, coupled with companies suspending dividends, pension and institutional capital will rediscover quickly that CRE provides the yield they cannot find elsewhere in corporate or municipal bonds, stocks, or U.S. Treasuries. Q1 earnings reports by the likes of ProLogis and Monmouth MREIC, as well as a new CPPI (Commercial Property Price Appreciation Index) by Real Capital Analytics reveal that commercial property prices across the board have not collapsed. Maybe PREA is getting in front of the market to the detriment of its investors. Such a move could cause it to sell off good assets and miss buying opportunities in say multifamily and industrial. The market is distinguishing among MSAs and property types in the capital it is deploying. Just reference the latest from Jim Costello at Real Capital Analytics from May 14, 2020:

“Commercial property prices pushed higher in the majority of leading global metros in the first quarter of 2020, the latest RCA CPPI Global Cities report shows, with the COVID-19 crisis not yet hitting sale prices. The headline rate of global price growth eased to 2.3% from a year ago and dipped 0.2% from the prior quarter, but most of the weakness came from declines already underway in Asia Pacific. Annual price growth for North American metros came in at +5.4%”

Second, a dearth of CRE transactions does not mean updated commercial real estate values are impossible, and thus all transaction activity must lockup. PREA (and the CRE industry at large) can look to entities (ACRE, the Appraisal and CCIM Institutes, and CRE data scientists like those at RCA and TREPP ) with experience using tools like a “market correction factor” DCF adjustment in the “Oil Patch” days in the 1980s to figure out the valuation puzzle and how to determine “material market condition” changes. Valuable clues as to vacancy, rent forbearance, leasing activity, Cap Rates, etc. are all contained in public earnings reports. For a recent perspective using these metrics, read ACRE’s feature from April 29, 2020 titled Drinking From a Firehose – Q1 2020 Earnings.

PREA will be back. CRE is where the yield is going to be found during and post COVID-19. The Federal Reserve has communicated zero interest rates for an extended period into 2021 or 2022, and corporations have a lot of work to do to their balance sheets to restore dividend payments. Therefore, CRE is going to be the place to find yield. Those that get it and know how to value it will get the better assets and deliver the better IRRs for investors. A closing tip for CRE valuation during a period of “Material Change” is the fifth piece of the puzzle from ACRE’s initial April 8, 2020, COVID-19 Valuation feature titled Five Pieces to the Appraisal Puzzle during COVID19:

#5 – Appraising during periods of “Material Change.” Material Change is a defined term in the Interagency Appraisal Guidelines that recognizes market conditions have been significantly disrupted and likely trigger valuation erosion. Appraisers need to reflect on periods like the Gulf of Mexico oil spill by BP in 2009 and even farther back to the initial oil patch shock and S&L Crisis of the late 1980s and early 1990s. There are important clues as to how to measure market conditions when economic data is stale or there is a dearth of sale and lease transactions. It requires more primary research by the appraiser and both appraisers and bankers need to allocate for that in both the time frame and fee to perform an appraisal in a period such as this. The best advice from a 30-year, multi-generation MAI appraiser that lived and practiced through all the aforementioned periods of “Material Change” is three-fold:

- Communicate with primary industry participants like brokers, property managers, lenders and university real estate centers as your subscription comp services are not going to have the same kind of forward-looking market intelligence;

- Ask a lot of “why” and “what if” questions (why is this shopping center still tenanted versus another one – tenant mix more weighted to consumer staples retail vs consumer discretion or experiential use) as they force you to look up and forward to the valuation answer. Read earnings reports for companies impacting your MSA or which are tenants in the real estate being appraised. They provide great forward-looking insights into what might be happening with regard to leasing activity (like the recent FedEx announcement on retail stores or Starbucks on rent payment intentions), market rent, rent forbearance, and even Cap Rates (ProLogis and Monmount MREIC in industrial warehouse sector).

- Revisit your appraisal template and refresh things like: i) Assumptions & Limiting Conditions to address topics like inspection; and Boiler-plate MSA analyses and statistics that are now all out of date and could result in a “misleading appraisal report.”

—

The Appraisal Institute and ACRE have been a resource on appraisal matters since the onset of COVID-19 and what is technically referred to by the CRE and banking industries as a period of “Material Change.” Important valuation resources exist at the Appraisal Institute (AI), The Appraisal Foundation (TAF), and the respective state appraisal boards – in Alabama the state board is the Alabama Real Estate Appraisers Board (REAB). Follow ACRE’s COVID-19 coverage at exploreACRE.com.