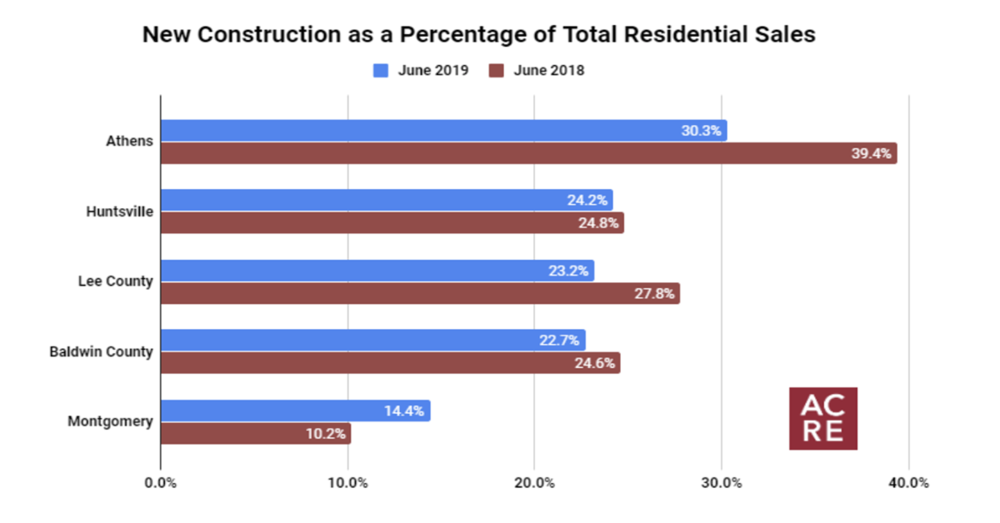

The Alabama Center for Real Estate created the following rankings based on new construction as a percentage of total residential sales during June.

- 1. Athens: 30.3%

- 2. Huntsville: 24.2%

- 3. Lee County: 23.2%

- 4. Baldwin County: 22.7%

- 5. Montgomery: 14.4%

June New Construction Recap

Statewide Overview: Alabama’s existing-home market had an impressive year in 2018 as total sales surpassed the high water mark set in 2005, and even with a drop year-over-year (Y/Y) in June, the state’s new construction market is also trending upwards. Total new construction sales have grown year-over-year in 40 of the past 44 months, an impressive streak going back to November 2015. Junes’s new construction sales decreased 7.7% from 855 closed transactions in June 2018 to 789 in June 2019. However, sales are up 5.6% year-to-date (YTD). Despite the upwards trends of new construction sales, listings remain tight compared to previous years. New construction listings have declined Y/Y in 10 of the last 13 months. With a 3.6% decrease in inventory this month, it was surprising to see the statewide median sales price decrease 4.9% when compared to the same time one year ago. Stay tuned to see if the state’s new construction and resale markets continue to match or surpass last year’s impressive results.

Athens: Even with a significant drop in new construction sales in June, Athens led the state in new construction as a percentage of total residential sales. Total sales of newly constructed residential housing in the Athens area (Limestone County) decreased 23% Y/Y from 74 closed transactions in June 2018 to 57 in June 2019. June’s median sales price decreased slightly (0.3%) from $279,735 to $278,900. Following statewide trends, new construction inventory has decreased Y/Y for 12 consecutive months in the Athens area. In June, listings declined 26.7% from 165 one year ago to 121 currently. Supply is tightening as there were 2.1 months of new construction supply in June. Average days on market increased from 38 to 52 days Y/Y. New construction represented 30.3% of all residential transactions in the area during June, down from 39.4% one year ago.

Huntsville: Even with a slight drop in June, Huntsville (Madison County) continues to lead other metro areas in the state in total new construction sales. While the 191 units sold represented a slight decrease (3%) from one year ago, the area is up 11.4% year-to-date. The June median sales price increased 6.2% Y/Y from $269,281 to $286,000, while it is up a modest 2.5% YTD. Mirroring statewide trends in the new construction market, inventory decreased 16.6% from 530 to 442 listings. Months of new construction supply tightened down to 2.3 months, and average days on market improved from 77 days one year ago to 58 currently. New construction represented 24.2% of all residential transactions in Huntsville area during June, down slightly from 24.8% one year ago.

Lee County: Total sales of newly constructed residential housing in Lee County decreased 27.3% Y/Y from 66 to 48 closed transactions. The June median sales price, however, increased 5.7% Y/Y from $301,963 to $319,114. Going against statewide trends, new construction inventory increased 15% Y/Y from 233 to 268 listings. With slowing sales and rising inventory, it was not surprising to see the area’s inventory to sales ratio rise from 3.5 months in June 2018 to 5.6 in June 2019. New construction listings sold an average of 2 days faster than one year ago as the area’s DOM average dropped from 131 to 129 Y/Y. New construction represented 23.2% of all residential transactions in the area during June, down from 27.8% one year ago.

Baldwin County: Total sales of newly constructed residential housing in Baldwin County decreased 17.1% Y/Y from 181 to 150 closed transactions. Sales are also down 2.3% YTD. June’s median sales price also decreased, falling 10.5% Y/Y from $256,310 one year ago to $229,400 currently. Going against statewide trends, Baldwin County’s new construction inventory increased 3.8% Y/Y from 559 to 580 listings. With slowing sales and rising inventory, it was not surprising to see the area’s inventory to sales ratio expand from 3.1 months in June 2018 to 3.9 in June 2019. Average days on market improved 4 days from 118 last year to the current level of 114. New construction sales represented 22.3% of all residential transactions in the area in June, down from 24.6% one year ago.

Montgomery: Total sales of newly constructed residential housing in the Montgomery area increased an impressive 25% Y/Y from 52 to 65 closed transactions. Median sales price was also on the rise during June as it increased 16.1% Y/Y from $237,843 in June 2018 to $276,240 in June 2019. Going against the statewide trend of declining new construction inventory, listings in the area were unchanged from one year ago. Months of new construction supply tightened from 2.9 to 2.3, while average days to sell improved from 112 one year ago to 107 currently.