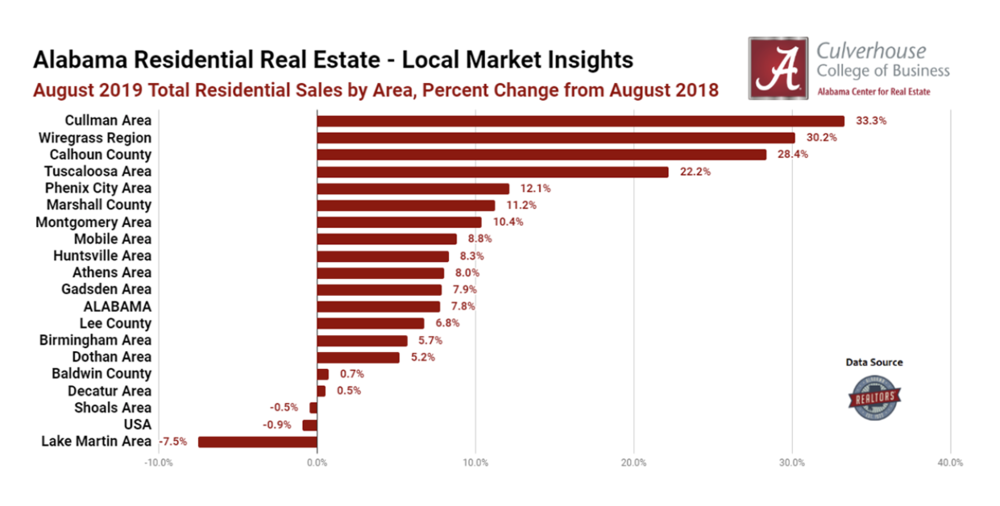

The Alabama Center for Real Estate created the following rankings based on year-over-year (Y/Y) growth in total residential sales during August.

1. Cullman Area: 33.3%

2. Wiregrass Region: 30.2%

3. Calhoun County: 28.4%

4. Tuscaloosa Area: 22.2%

5. Phenix City Area: 12.1%

Alabama: 7.8%

United States: -0.9%

Cullman County: Total residential sales in Cullman County increased 33.3% (Y/Y) from 81 to 108 closed transactions in the month of August. The year-to-date residential sales increased 13.1% from one year ago. The August median sales price increased 13.4% (Y/Y) from $149,900 to $169,950, and increased 9.5% from the prior month. Dollar Volume made a significant increase of 26.09% (Y/Y) from $16.7 million to $21 million. Inventory decreased 6.9% (Y/Y) from 479 residential listings one year ago to 446 in August. Additionally, the average days on market (DOM) decreased from 134 to 100, a 25.4% (Y/Y) decrease. Lastly, months of supply decreased 30.2% during the same period from 5.9 to 4.1 months, reflecting a seller’s market in the area.

Wiregrass Region: The Wiregrass Region experienced a 30.2% increase (Y/Y) in total sales in August, increasing from 96 to 125 closed transactions. The year-to-date residential sales increased 3.6% from one year ago. The August median sales price increased 1.4% (Y/Y) from $139,000 to $141,000, the median sales price since July has decreased by 5.4%. Dollar volume increased 5.88% (Y/Y), increasing from $14.8 million to $17.5 million. Wiregrass saw a 30.1% (Y/Y) decrease in inventory, going from 705 to 493 units. The average days on market (DOM) saw a decrease, as it decreased 7.3% (Y/Y) from 96 to 89. The average months of supply in Wiregrass decreased 46.3% during the same period, going from 7.3 months to 3.9 months, creating a stronger market for sellers.

Calhoun County: Total residential sales in Calhoun County increased 28.4% (Y/Y) from 155 to 199 closed transactions. The year-to-date residential sales increased 5.5% from one year ago. The August median sales price decreased 2.8% (Y/Y) from $149,000 to $144,900 currently. Dollar Volume saw an increase of 3.15% (Y/Y) from $27 million to $27.8 million. Inventory in Calhoun County decreased 21.2% (Y/Y), decreasing from 868 to 684. Calhoun County had a significant decrease in average days on market (DOM) with a decrease of 17.6% (Y/Y) from 74 to 61. Calhoun County’s months of supply declined, falling 38.6% (Y/Y) from 5.6 to 3.4 months. Calhoun’s month of supply reflects a seller’s market in the area.

Tuscaloosa Area: Tuscaloosa experienced a 22.2% increase (Y/Y) in total sales in August, increasing from 234 to 286 closed transactions. The year-to-date residential sales increased 1.9% from one year ago. The August median sales price increased 6.0% (Y/Y), from $169,700 to $179,900. The Tuscaloosa Area experienced an increase in dollar volume of 9.91% (Y/Y), rising from $52.7 million to $57.9 million. Tusacaloosa’s inventory decreased 0.7% (Y/Y), from 838 homes listed last year to 832 currently. Tuscaloosa experienced a decrease in average days on market (DOM) from 67 in August 2018 to 45 in August 2019 (Y/Y). Lasty, the months of supply had a decrease of 18.8% during the same period going from 3.6 months to 2.9 months, creating a market where sellers typically have higher bargaining power.

Phenix City Area: Residential sales in the Phenix City Area increased 12.1% (Y/Y) from 132 to 148 closed transactions. The year-to-date residential sales increased 19.3% from one year ago. The Phenix City Area’s August median sales price increased 8.0% (Y/Y), increasing from $168,450 to $182,000. Dollar volume increased 29.05% (Y/Y), seeing gains from $23 million to $29.8 million. The Phenix City Area saw a 22.3% (Y/Y) decrease in inventory from 485 to 377 units. The area’s average number of days on market (DOM) decreased 20.9% (Y/Y) from 115 to 91 days. In addition, the months of supply in the Phenix City Area decreased by 30.7% (Y/Y) going from 3.7 to 2.5 months. This indicates a market where sellers typically have higher bargaining power.