Alabama’s self-storage market is heating up, providing another pillar of support to Alabama real estate. Self-storage veteran, Bill Barnhill, CCIM, reports that there is over 1,000,000 square feet planned or under construction in Alabama.

While self-storage was once considered the ugly step-sister of real estate, it now has become its Cinderella with some store lobbies and facades rivaling those of 4-star hotels, capturing the interest of Wall Street.

Development:

Because the economy is flourishing and Alabama added a record-breaking 4,300 jobs in April, veteran developers and a number of new developers are being enticed to add new product to Alabama’s self-storage market. The market is definitely showing attractive return on investment, a healthy 90 percent occupancy statewide, and an increase in demand, especially for climate controlled offerings. However, a few submarkets could be at risk of becoming overbuilt if all of the new planned projects reach fruition.

Some owners are preparing for the impending onslaught of new supply by offering special discounts. “I know of specific cases in Mobile, Alabama, where existing stores are offering such discounting,” said Barnhill.

In spite of this discounting, most self-storage owners will continue to push rents up as long as they can until there is actually significant new competition. This push in the pipeline will have varying effects across Alabama submarkets.

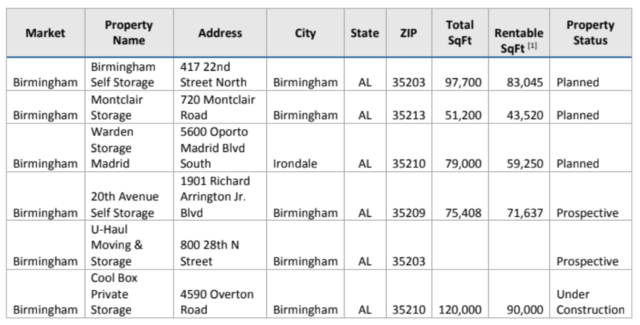

Birmingham

Birmingham has the greatest market share in new development with over 500,000 square feet planned or under construction. Will Birmingham storage owners feel the pressure of the new product as new units come online? A number of Birmingham submarkets could be over-served.

***Chart data courtesy of Yardi Matrix, REIS and local sources. This information has been obtained by third parties. The accuracy or completeness of the information cannot be guaranteed.

Huntsville

Huntsville’s self-storage market is buoyed by the area’s new industry such as the new Toyota-Mazda plant, Remington, and Facebook that collectively promise over 6,000 new jobs.

There is over 89,000 square feet of self-storage construction underway in the Huntsville market by NitNel Partners at Highway 72 West. Additionally, Safe Mini Storage opened several properties 2016. Huntsville’s Triad Group just opened 517 units at 11580 Memorial Parkway Southeast in South Huntsville

Mobile

While Mobile and surrounding Baldwin counties are boasting new industrial growth like Airbus alongside the expansion of the Port, there was only one new facility built in the area thus far this year.

“In Foley overbuilding may be forthcoming due to a planned three story 90,000 square foot climate controlled building on Highway 59 and plans for a 61,200 square foot property at nearby County Road 8 East and the Foley Beach Express. Rumors about two other projects in the area being planned but not permitted may be underway,” said Barnhill.

Sales

Overall Alabama’s self-storage market is healthy and gaining more interest in the real estate and investment realm as it continues to offer steady returns. While there is a group of new investors dipping their toes into self-storage, the majority of self-storage holdings are held by longtime owners and investors.

“There is a group of new owners and institutions who are hungry to get a piece of the pie because of the growth, security, and low maintenance fees, but the majority are still the older individual owners. Interest has peaked among institutional buyers but I think we will see more of them over the next few years. It is harder for individuals who don’t have an in-depth understanding of the market to compete,” said Barnhill.

The upward trends suggest a direct correlation to the boom in the housing industry. Only about 15 to 20 percent of units are rented by commercial businesses depending on the nature of the specific market area.

Most units are rented to individuals with an average rental period of 7- 9 months. As people are moving, buying, building, and selling their homes, occupancy and demand increase.

All in all, Alabama’s self-storage market as an asset class is catching the attention of large equity funds and is expected to grow as Alabama continues to create new jobs pushing the housing industry and in turn the self-storage industry.

Bill Barnhill, CCIM is a veteran self-storage developer, broker and broker affiliate of Argus Self Storage Sales Network.