Through the first quarter of 2018, both the United States and Alabama experienced a decrease in their foreclosure and delinquency rates. The question we were left with was if that trend will continue through the second quarter of this year. According to data from CoreLogic, both the US and Alabama saw a decrease in their delinquency and foreclosure rates.

The United States saw sizable decreases in foreclosure rates through June 2018. The United States foreclosure rate decreased .2 percent, dropping to .5 percent. Moreover, the US delinquency rate for 30 or more days past due and over 120 days past due decreased .3 percent and .2 percent respectively. The Mortgage Bankers Association also reported that the delinquency rate was down 27 basis points from the previous quarter. However, it increased 12 basis points from one year ago. Furthermore, mortgage delinquencies dropped across all stages of delinquency in the second quarter of 2018 compared to the first quarter of 2018. The 30-day delinquency rate dropped two basis points from the previous quarter, while the 60-day and 90-day delinquency buckets dropped by eight and 18 basis points respectively. More solid news for home buyers, the delinquency rate for conventional loans decreased 33 basis points over the previous quarter to 3.45 percent.

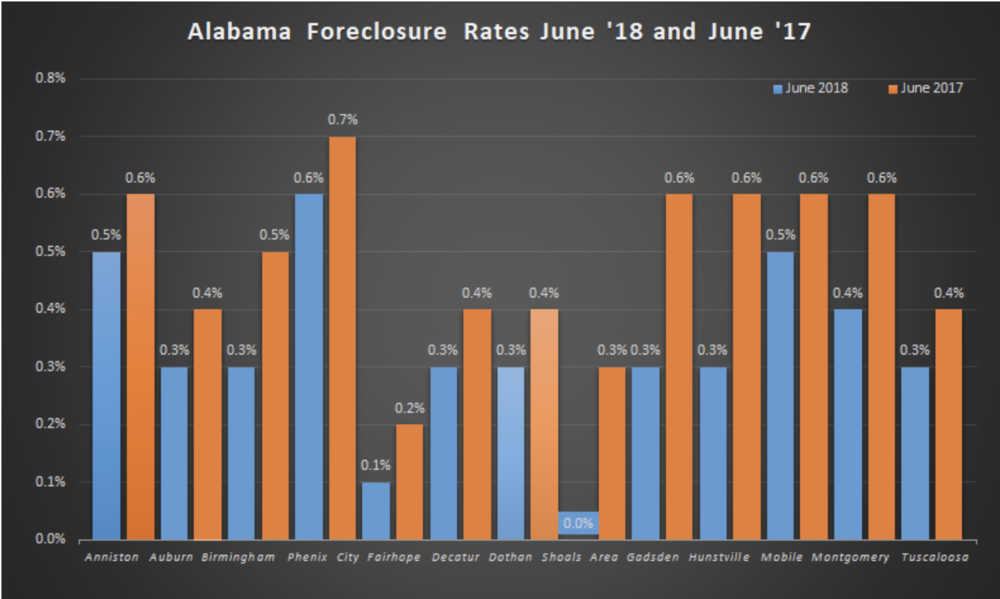

Through June 2018, Alabama’s percentage of payments 30 plus days delinquent and 90 plus days delinquent saw a decrease. Year-over-year changes from 2017 to 2018 saw 30 plus days delinquent payments decrease from 6.3 percent to 5.9 percent, while 90 plus days delinquent payments decreased .4 percent, from 2.5 to 2.1 percent. Similarly, the foreclosure rate decreased .2 percent, from .5 to .3 percent. Eleven of the 12 metro areas in the state saw decreases in foreclosure rates including: Tuscaloosa, Huntsville, Decatur, Mobile, Baldwin County and Auburn-Opelika which all saw a .1 percent decrease. Birmingham and Montgomery both experienced a .2 percent decrease in their foreclosure rates. Gadsden saw the largest decrease, with their respective rate declining by .3 percent. Notwithstanding, the Muscle Shoals and Florence area foreclosure rate remained constant at .3 percent. The full state statistics by CoreLogic can be viewed here.

The continuing decrease of the foreclosure and delinquency rates in the US and Alabama can be attributed to the higher employment and wage increases throughout the country. Additionally, the state of Alabama jumped to number 3 in the rankings of “Top States for Business.” The state also ranked first in three individual categories, including: most improved economic policies, favorable utility rates, and favorable general regulatory environment. It will be interesting to see how these trends will continue throughout the rest of 2018.