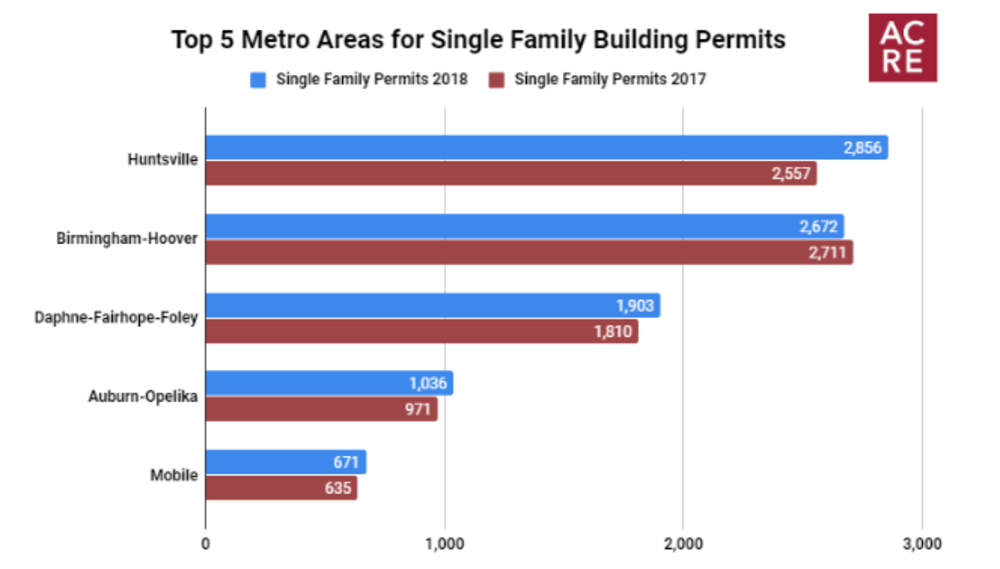

The Alabama Center for Real Estate created the following rankings based on total single family building permits in 2018.

1. Huntsville – 2,856

2. Birmingham-Hoover – 2,672

3. Daphne-Fairhope-Foley – 1,903

4. Auburn-Opelika – 1,036

5. Mobile – 671

Statewide, Regional, and National Overview

2018 was a strong year for new construction as single family building permits increased year-over-year (YoY) in Alabama, the South region, and the United States. In Alabama, single family permits increased 7.8 percent from 12,005 in 2017 to 12,938 in 2018. Single family permits in the South region (Mississippi, Alabama, Georgia, Florida, South Carolina, North Carolina, Tennessee, Kentucky, West Virginia, Virginia, Maryland, and Delaware) increased 5 percent YoY while nationwide permits increased 4.2 percent YoY.

The South region accounted for roughly 55 percent of all new single family permits in the nation during 2018. Of the 854,241 permits issued in the United States, 466,748 were in the South region.

Metro Area Overview

The Huntsville metro area lead the state in new construction activity during 2018. Single family permits in the area increased 10.8 percent YoY from 2,557 in 2017 to 2,856 in 2018. Housing starts were also on the rise as they increased 11.6 percent from 2,550 to 2,846. New construction sales in the Huntsville metro area increased 9.2 percent YoY from 2,302 to 2,514 closed transactions. The median sales price for new construction in the area increased 2.9 percent YoY from $255,059 to $262,368. New construction represented 26 percent of all closed residential transactions in the area during 2018.

With 2,672 new single family permits, the Birmingham-Hoover metro area was a close second in new construction activity during 2018. Going against statewide trends, permits in the area decreased 1.4 from the 2,711 permits issued in 2017. While Birmingham-Hoover lead the state in new construction activity from 2013-2017, Huntsville regained the top spot in 2018. Housing starts were also on the decline as they fell 2.8 percent from 2,726 to 2,650. New construction sales, however, increased 10.8 percent from 1,675 in 2017 to 1,855 in 2018. The median sales price for new construction in the area increased 6.1 percent YoY from $264,026 to $280,150. New construction represented 12 percent of all closed residential transactions in the area during 2018.

The Daphne-Fairhope-Foley metro area was third in the state in new construction activity during 2018. Single family permits in the area increased 5.1 percent YoY from 1,810 in 2017 to 1,903 in 2018. Housing starts were also on the rise as they increased 7 percent from 1,798 to 1,924. New construction sales in the Daphne-Fairhope-Foley metro area increased 23.6 percent YoY from 1,182 to 1,461 closed transactions. However, the median sales price for new construction in the area decreased 1.5 percent YoY from $253,399 to $249,654. New construction represented 21 percent of all closed residential transactions in the area during 2018.

The Auburn-Opelika metro area was fourth in the state in new construction activity during 2018. Single family permits in the area increased 6.7 percent YoY from 971 in 2017 to 1,036 in 2018. Housing starts were also on the rise as they increased 6.2 percent from 975 to 1,035. New construction sales in the Auburn-Opelika metro area increased 11.2 percent YoY from 544 to 605 closed transactions. The median sales price for new construction in the area increased 7.3 percent YoY from $279,084 to $299,508, making it the most expensive market for new construction in the state. New construction represented 29 percent of all closed residential transactions in the area during 2018.

The Mobile metro area was fifth in the state in new construction activity during 2018. Single family permits in the area increased 5.7 percent YoY from 635 in 2017 to 671 in 2018. Housing starts were also on the rise as they increased 4.4 percent from 646 to 674. New construction sales in the Mobile metro area, however, decreased 2.8 percent YoY from 326 to 317 closed transactions. The median sales price for new construction in the area decreased 0.6 percent YoY from $216,135 to $214,904. New construction represented 7 percent of all closed residential transactions in the area during 2018.