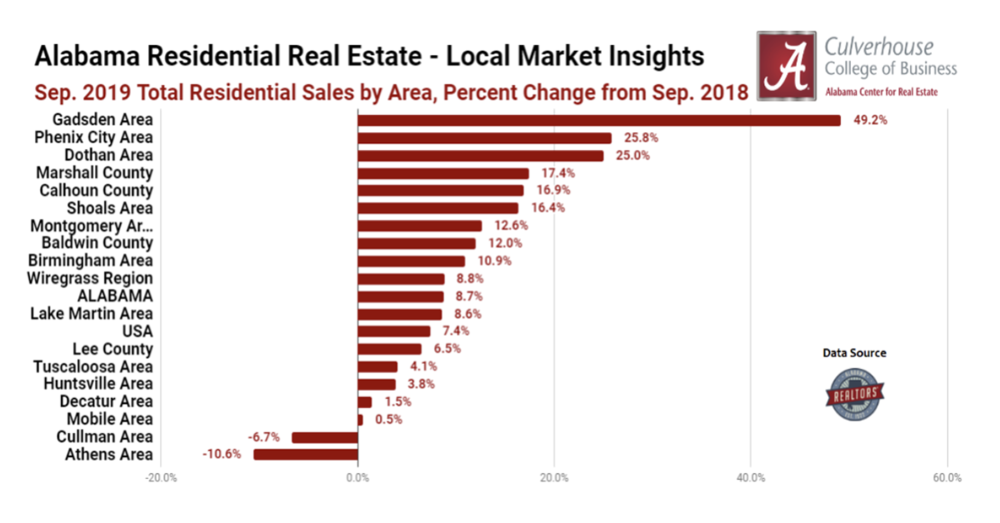

The Alabama Center for Real Estate created the following rankings based on year-over-year (Y/Y) growth in total residential sales during September.

- 1. Gadsden Area: 49.2%

- 2. Phenix City Area: 25.8%

- 3. Dothan Area: 25%

- 4. Marshall County: 17.4%

- 5. Calhoun County: 16.9%

Alabama: 8.7%

United States: 7.5%

Gadsden Area: Total residential sales in the Gadsden Area increased 49.2% (Y/Y) from 61 to 91 closed transactions in the month of September. The year-to-date residential sales increased 5.1% from one year ago. The September median sales price increased 20.9% (Y/Y) from $114,900 to $138,900, and decreased 10.2% from the prior month. Dollar Volume made a significant increase of 75.47% (Y/Y) from $7.4 million to $13 million. Inventory decreased 17.6% (Y/Y) from 511 residential listings one year ago to 421 in September. Additionally, the average days on market (DOM) decreased 12% (Y/Y), going from 92 to 81. Lastly, months of supply decreased 44.8% (Y/Y) during the same period going from 8.4 to 4.6 months, reflecting a market where sellers typically have elevated bargaining power.

Phenix City Area: The Phenix City Area experienced an increase of 25.8% (Y/Y) in total sales in September, increasing from 89 to 112 closed transactions. The year-to-date residential sales increased 29.4% from one year ago. The September median sales price increased 5.1% (Y/Y) from $166,500 to $174,950, the median sales price since August has decreased by 3.9%. Dollar volume increased 35.38% (Y/Y), increasing from $15.2 million to $20.6 million. Phenix City saw a 14.7% (Y/Y) decrease in inventory, going from 468 to 399 units. The average days on market (DOM) saw a decrease, as it decreased 17.5% (Y/Y) from 126 to 104. The average months of supply in Phenix City decreased 32.3% (Y/Y) during the same period, going from 5.3 months to 3.6 months, showing a continued trend where sellers typically have the bargaining power.

Dothan Area: Total residential sales in the Dothan Area increased 25.0% (Y/Y) from 128 to 160 closed transactions. The year-to-date residential sales increased 12.2% from one year ago. The September median sales price decreased 5.5% (Y/Y) from $156,456 to $165,00 currently. Dollar Volume saw an increase of 34.98% (Y/Y) from $22.1 million to $29.9 million. Inventory in the Dothan Area decreased 21.5% (Y/Y), decreasing from 1,028 to 807. The Dothan Area had an increase in average days on market (DOM) of 6.6% (Y/Y) from 121 to 129. The Dothan Area’s months of supply declined, falling 37.2% (Y/Y) from 8.0 to 5.0 months. Dothan’s month of supply reflects a seller’s market in the area.

Marshall County: Marshall County experienced a 17.4% increase (Y/Y) in total sales in September, increasing from 69 to 81 closed transactions. The year-to-date residential sales increased 1.4% from one year ago. The September median sales price increased 30.4% (Y/Y), from $130,000 to $169,500. Marshall County experienced an increase in dollar volume of 65.1% (Y/Y), rising from $10.7 million to $17.7 million. Marshall County’s inventory decreased 14.4% (Y/Y), from 388 homes listed last year to 332 currently. Marshall County experienced an increase in average days on market (DOM) of 23% (Y/Y) going from 74 to 91. Lasty, the months of supply had a decrease of 27.1% during the same period going from 5.6 months to 4.1 months, creating a market where sellers typically have higher bargaining power.

Calhoun County: Residential sales in Calhoun County increased 16.9% (Y/Y) from 142 to 166 closed transactions. The year-to-date residential sales increased 7.4% from one year ago. Calhoun County’s September median sales price increased 8.0% (Y/Y), increasing from $129,900 to $139,450. Dollar volume increased 19.89% (Y/Y), seeing gains from $20.8 million to $25 million. Calhoun County saw a 6.1% (Y/Y) decrease in inventory from 767 to 720 units. The area’s average number of days on market (DOM) decreased 20.9% (Y/Y) from 67 to 53 days. In addition, the months of supply in Calhoun County decreased by 19.7% (Y/Y) going from 5.4 to 4.3 months. This indicates a market where sellers typically have higher bargaining power.