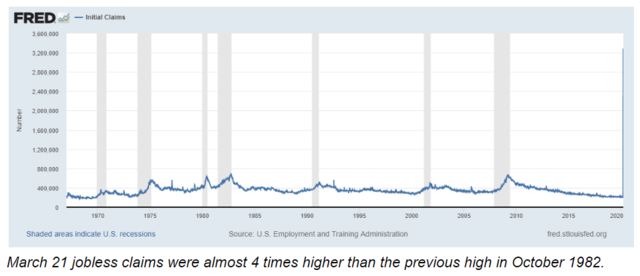

The historic week continued Thursday March 26 as a record number of Americans filed for unemployment benefits due to businesses shutdowns to slow the spread of COVID-19. Initial jobless claims reached a seasonally adjusted rate of 3.28 million for the week ending March 21, the highest number in history. The previous high of 695,000 was on October 2, 1982, and reached 665,000 on March 28, 2009. Current levels are off the charts, literally, up 372% from the previous highs.

Fortunately, a federal relief plan is underway. Congress took historic action Wednesday by passing $2 trillion in virus relief. The legislation is vast, including (but not limited to) expansion of unemployment benefits, relief for families, small businesses, health care providers, corporations, and state and local governments. The stimulus package also provides for loans to relieve real estate sectors hit especially hard by the emergency. Struggling hotels and retailers are eligible for relief loans, while multifamily borrowers have the option to temporarily defer payments. During the forbearance period, however, tenants cannot be evicted due to missing rent payments or charge late fees. The good news is that help is on the way as relief is taking many forms. Some landlords are offering reduced rental rates, while others are forgiving April rent payments. Of course this varies from situation to situation, but many individuals are taking action which will only boost federal, state, and local efforts.

Even with the record jobless claims headlines, investors displayed optimism as the Dow Jones was up 4.4% by early afternoon. Crude oil, however, continues its free fall, down 7.7% to $22.60 per barrel. While good for consumers, falling oil prices have dragged down oil stocks, contributing to the bear market. The industry, however, has dealt with downturns and price volatility many times before. A price war between Saudi Arabia and Russia initially caused oil prices to plummet, while also creating turmoil in stock markets around the globe. Demand is sharply lower as people work remotely, cancel travel plans, stay at home and distance themselves while doing their part to flatten the curve.

Even though the United States is the largest oil producer in the world, the extraction and refining of oil and gas only represents about 1.7% of the national economy. The other side of the coin, however, is that our lives run largely on oil, and when one accounts for related industries outside of extraction and refining, oil and natural gas account for a significant portion (roughly 8%) of GDP.

Who knows what we will see in the weeks and months ahead. Financial markets are trending upwards, for the moment at least, but volatility and uncertainty still lie ahead. Thanks to the stimulus, we do know that most American households are set to receive a cash infusion in as little as 3 weeks, likely as a direct payment from the Internal Revenue Service. But concerns are still numerous, especially the huge jump in jobless claims this week. There’s also the “what don’t we know today” factor that continues to unfold as we adapt in these trying times.