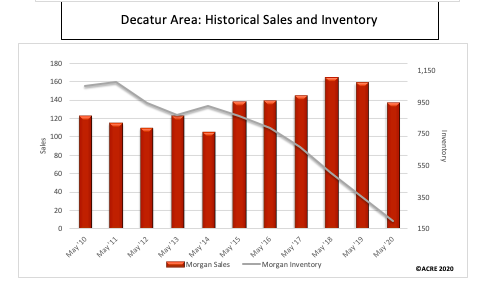

Sales: According to the Morgan County Association of Realtors, May residential sales in the Decatur area (Morgan and Lawrence Counties) decreased 13.9% year-over-year from 158 to 136 closed transactions. Going against seasonal trends, sales decreased 4.9% from April. Sales are down 6.2% year-to-date, and slowing sales activity is likely to continue in the months ahead due to the growing economic impact of the COVID-19 pandemic. Two more resources to review: Quarterly Report and Annual Report.

For all of Morgan County’s housing data, click here.

Inventory: Total homes listed for sale in May declined 43.8% year-over-year from 354 to 199 listings. Months of supply declined from 2.2 to 1.5, reflecting a market where seller’s generally have elevated bargaining power.

Pricing: The area’s median sales price in May was $163,750, an increase of 5.7% from one year ago and a decrease of 0.8% from April. The differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. ACRE recommends consulting with a local real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood.

Homes sold in May averaged 59 days on the market (DOM), 1 day slower than May 2019.

Forecast: May sales were 43 units, or 24%, below the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE projected 179 sales for the month, while actual sales were 136 units. ACRE forecast a total of 691 residential sales in the area year-to-date, while there were 626 actual sales through May, a difference of 9.4%.

Click here to view the entire monthly report.

The Morgan County (Decatur) Residential Monthly Report is developed in conjunction with the Morgan County Association of Realtors to better serve area consumers.

Editor’s Note: All information in this article reflects data provided to the Alabama Center for Real Estate for the time period May 1 – 31, 2020. Thus, the performance represented is historical and should not be used as an indicator of future results, particularly considering the upcoming impact of COVID-19 on the housing market.