Sales: According to the Etowah-Cherokee Association of Realtors, May residential sales in the Gadsden area decreased 4.6% year-over-year from 87 to 83 closed transactions. Following seasonal trends, sales increased 12.2% from April. Sales are up 10.3% year-to-date, but are likely to moderate in the months ahead due to the economic impact of COVID-19. Two more resources to review: Quarterly Report and Annual Report.

For all of the Gadsden area’s housing data, click here.

Inventory: Following regional trends but to a greater degree, total homes listed for sale in May decreased 33.1% year-over-year from 393 to 263 listings. Months of supply dropped from 4.5 to 3.2, reflecting a market where sellers generally have elevated bargaining power.

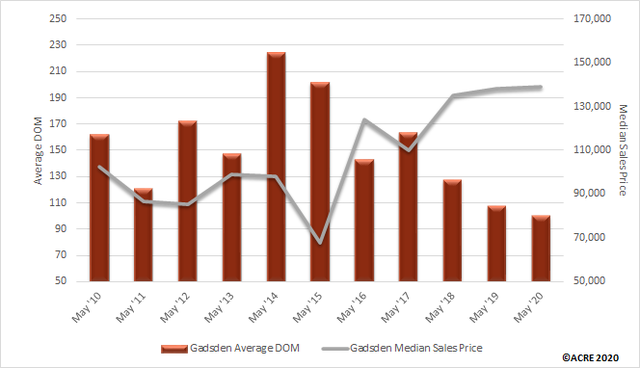

Pricing: The area’s median sales price in May was $138,900, an increase of 0.7% from one year ago and a decrease of 8% from the prior month. The differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. ACRE recommends consulting with a local real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood.

Homes sold in May averaged 100 days on market, 7 days faster than May 2019.

Forecast: May sales were 11 units, or 11.7%, below the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE projected 94 sales for the month, while actual sales were 83 units. ACRE forecast a total of 393 residential sales in the area year-to-date, while there were 387 actual sales through May, a difference of 1.5%.

Click here to view the entire monthly report.

The Gadsden Residential Monthly Report is developed in conjunction with the Etowah-Cherokee Association of Realtors to better serve area consumers.

Editor’s Note: All information in this article reflects data provided to the Alabama Center for Real Estate for the time period May 1 – 31, 2020. Thus, the performance represented is historical and should not be used as an indicator of future results, particularly considering the upcoming impact of COVID-19 on the housing market.