The housing industry, like the technology industry and the NASDAQ stock index, appears to be one of those exceptions to the coronavirus where “Everything is Awesome”. Consider the most recent headlines regarding overall housing data from June 2020 that parallels what ACRE Residential Research has evidenced in Alabama housing (May 2020 new home sales up 7.2%):

- Pending Home Sales, June 29, 2020: Pending Home Sales Post Record Gain up 44%. The National Association of Realtors’ index of pending home sales increased 44.3% in June 2020 to a three-month high of 99.6, after falling in April to the lowest level in records back to 2001. The National Association of Realtors project existing home sales to reach 4.93 million units this year, up from a previous forecast of 4.77 million. In 2019, there were approximately 5.3 million previously owned homes sold.

- Home Price Appreciation, June 30, 2020: Housing Price Growth Surprisingly Stable Amid Coronavirus – The S&P CoreLogic Case-Shiller national home price index posted a 4.7% annual gain up from 4.6% the previous month beating estimates of 4.5%. The 20-City Composite posted a 4% annual gain, up from 3.9% also beating estimates of 3.8%. The price trend that was in place pre-pandemic seems so far to be undisturbed, at least at the national level.

- National Association of Homebuilders Housing Market Index (HMI), June 16, 2020: Builder Confidence Surges in June. In a sign that housing stands poised to lead a post-pandemic economic recovery, builder confidence in the market for newly-built single-family homes jumped 21 points to 58 in June 2020, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Any reading above 50 indicates a positive market.

What the aforementioned data portrays is the condition of housing for the upper two quartiles of the housing market consisting primarily of homeowners, renters, and prospective buyers that can work remote and/or are employed in vital logistics, supply-chain, technology, and essential services industries. However, there is another quartile of the housing industry that is not doing well – the 25% quartile struggling to make rent and mortgage payments. The conditions for this quartile are not making their way into the housing headlines and are being overlooked by the homebuilding industry and noted analysts, such as Ivy Zelman, CEO of Zelman & Associates.

This quartile is material and worthy of some focus for several reasons. First, this quartile is not concentrated in a single price point, industry sector, or region of the United States. It cuts across the country and state of Alabama and includes middle-income as well as lower-income households. Second, this quartile is material in size, and is now approaching 20% of all single and multifamily households. This is the segment of our housing industry that cannot make their rent or mortgage payment due to some level of employment disruption. And third, the statistics for this overlooked quartile of our housing market surpass anything experienced previously – even during the 2007-2010 housing crisis and Great Recession. Eventually, this quartile’s housing stress will impact the broader housing market. A healthy housing industry is not sustainable when one in five households cannot afford to pay their rent or mortgage. And the stress in this quartile will likely creep up into the mid-quartiles of housing if the coronavirus continues unabated requiring reopening rollbacks by states, and a flood of company bankruptcies this fall after the CARES Bill employment conditions end. Already we are experiencing this scenario in large and important housing industry states such as California, Texas, Arizona and Florida. Airlines, hotel companies, national restaurant chains, service companies, and tens of thousands of small businesses face bankruptcy this fall. Q2 earnings commencing this week will shed more light on this reality. When companies like Wells Fargo Bank (eliminating thousands of jobs in 2H2020) are among the many companies reported by Challenger-Gray as cutting approximately 1.2 million jobs in Q2, the stress in housing is going to expand from the 25%-quartile up into the middle quartiles. Are we prepared for the “Everything is Awesome” aforementioned housing metrics to turn less-awesome? What is happening in this overlooked housing quartile is the canary-in-the-coal-mine warning for the overall housing industry. Consider the following statistics and data not making the mainstream media or housing industry headlines:

- Q2 2020 had the highest quarterly tally for job cuts on record at 1.2 million (these are not yet in BLS Jobs count)

- 4.2 million homeowners are in forbearance plans: According to the Mortgage Banker Association’s (MBA) June 2020 data, this figure represents more than 8% of all mortgage loans in the U.S. This ratio going into 2020 was approximately 0.25% – and the level that this ratio was previously regarded as elevated for mortgages in loan forbearance was 1%. While the MBA reported in its June data that this ratio declined eight basis points from 8.47% to 8.39%, what wasn’t reported is that those in forbearance programs are applying for extensions of their forbearance period from 3 months to 6 or 12 months. In other words, the households in this housing quartile are more impacted by unemployment from COVID-19 and are not being readily re-employed. Many of these households are impacted by job loss in retail, leisure and travel, manufacturing, and non-essential services industries where the unemployment rate is much higher than the national 11.1% U-3, or 18% U-6 total unemployment rates. The eight basis-point June decline is not material, and may be more attributable to the increasing processing times for a loan forbearance request due to the volume of requests for both first-time and renewal extensions. This explanation is consistent with the rise in mortgage loan delinquencies as unemployed homeowners waiting on a loan forbearance agreement are going delinquent at an increasing rate.

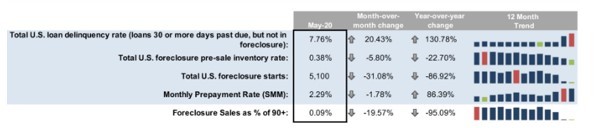

- 4.3 million households are delinquent in their mortgages – up another 723,000. According to Black Knight, another 723,000 homeowners became past due on their mortgages in May 2020, pushing the national delinquency rate to its highest level in 8.5 years. There are now 4.3 million homeowners past due on their mortgages or in active foreclosure – up from 2 million at the end of March. The following is a stratification of this data for the May 2020 period released by Black Knight on June 22, 2020. Note the decline in foreclosure actions is due to foreclosure and eviction moratoriums. As these moratoriums lift in 2H2020, a different picture will emerge.

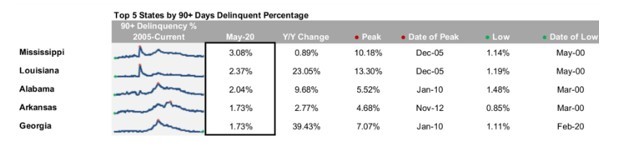

Who are the states most impacted? Black Knight stratifies this data as well. The five states experiencing the highest rates of mortgage delinquency are quite varied and range from Mississippi & Louisiana (impacted by manufacturing, port/supply-chain disruption as well as leisure and travel) to New York region (epicenter of COVID-19 outbreak with the most coronavirus cases still to date) and Florida (a top 5 housing state).

Of concern for Alabama is that it ranks among the top-5 states for mortgages that are 90+ days delinquent. Alabama was hit hard early on with respect to its auto and aircraft manufacturing industries including Airbus, Honda, Mercedes, Toyota, etc. What is encouraging news on this front is that Alabama now has an unemployment rate back below 10% or half that of the national 18% U-6 total unemployment rate.

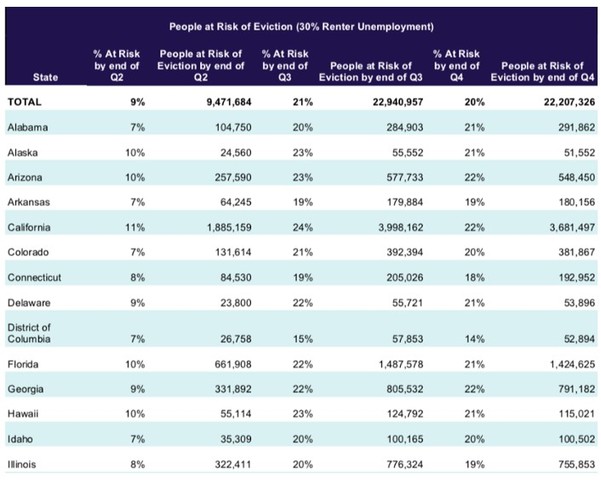

- Approximately 20 million of renters, or one in five of the 110 million Americans who live in renter households, are in some form of a rent forbearance program and faced eviction at the end of July 2020 if the FHFA had not extended its eviction and rent forbearance program recently from 3 to 6 months, according to the Aspen Institute. While Alabama has a comparatively smaller ratio of renters facing eviction without rent forbearance compared to Florida (10%), Georgia (9%) or Louisiana (8%), it is still elevated at 7% or 300,000 by Q3, 2020.

In aggregate, 30 million households are in mortgage forbearance, delinquency or MF rent forbearance. That figure translates to 23% of the 129.5 million total U.S. households according to the Census Bureau at the end of 2019. This 25% quartile is in a housing crisis. Not since the Great Depression has our country confronted these kinds of figures for households unable to pay rent or their mortgage. The only thing propping up this crisis is intervention by the FHFA and Federal Reserve. If COVID-19 cases continue on their pace of setting daily records (3.3 million U.S. cases as of July 13, 2020 – or 25% of the world’s total with 55,000 cases in Alabama), states return to the Phase-I reopening stage, and unemployment rises this fall with the expected rise in bankruptcies, the “everything is awesome” story in the middle and upper quartiles of the housing industry will become impacted. This 25% quartile in housing is the canary-in-the-coal-mine for housing that cuts across all demographic segments. Lower and middle-class households alike are unemployed and can’t make their rent or mortgage payment. Residents of all states from Alabama to California have industries severely impacted by COVID-19 with many companies on the verge of bankruptcy. The same is true for Alabama small businesses, and even those in logistics. Last week, Foster Freight, LLC, a small Alabama trucking company located in Clayton, Alabama that specialized in transporting general and refrigerated freight, filed bankruptcy despite receiving financial support from a Paycheck Protection Plan (PPP) loan.

Don’t overlook this housing quartile. On July 9, 2020, ACRE hosted a podcast with Cathy James from the Alabama Housing Finance Authority on just this topic titled: “Hardest Hit Alabama”. The Alabama Housing Finance Authority’s (AFHA) foreclosure prevention program “Hardest Hit Alabama” provides up to $30,000 in short-term mortgage payment assistance to eligible homeowners who have lost employment or income due to COVID-19. AHFA was established by the Alabama Legislature in 1980 to serve the housing needs of low- and moderate-income Alabamians and create housing opportunities through the affordable financing of single- and multifamily housing. Check out this important podcast by ACRE’s Director of Education, Marketing & Communications Cherie Moman.

ACRE remains committed to its COVID-19 coverage at exploreACRE.com to bring you the insights needed to Look Up & Forward and do the necessary “what if” thinking.