TUSCALOOSA, Ala. — Buying a home in Alabama remains a challenge as both interest rates and home prices continue to climb.

A new report from the Alabama Center for Real Estate (ACRE) shows that the state’s Housing Affordability Index (AHAI™) declined by 0.49% in the first quarter of 2025 compared to the previous quarter. The drop in affordability is largely due to a 3.5% increase in the median home sales price statewide and a rise in 30-year fixed mortgage rates, which went from an average of 6.65% in Q4 2024 to 6.82% in Q1 2025.

Despite these headwinds, rising incomes helped to soften the blow. In 2025, Alabama’s estimated median family income rose 4.7% year-over-year, according to the U.S. Department of Housing and Urban Development. Nationally, the median family income saw a larger increase of 6.5% during the same period.

While Alabama’s overall affordability score improved 4.7% from Q1 2024, the national index experienced a greater year-over-year increase of 6.5%.

Regional Highlights:

- Eight of Alabama’s 12 metro areas saw improved affordability compared to the previous quarter.

- Decatur posted the highest quarterly gain, with affordability up 12.95%, followed by Tuscaloosa with a 5.57% increase.

- Among non-metro areas, Marshall County saw the largest jump, with its affordability index climbing 23.86%. ACRE notes that smaller areas may experience more volatility in median home prices due to limited sales data.

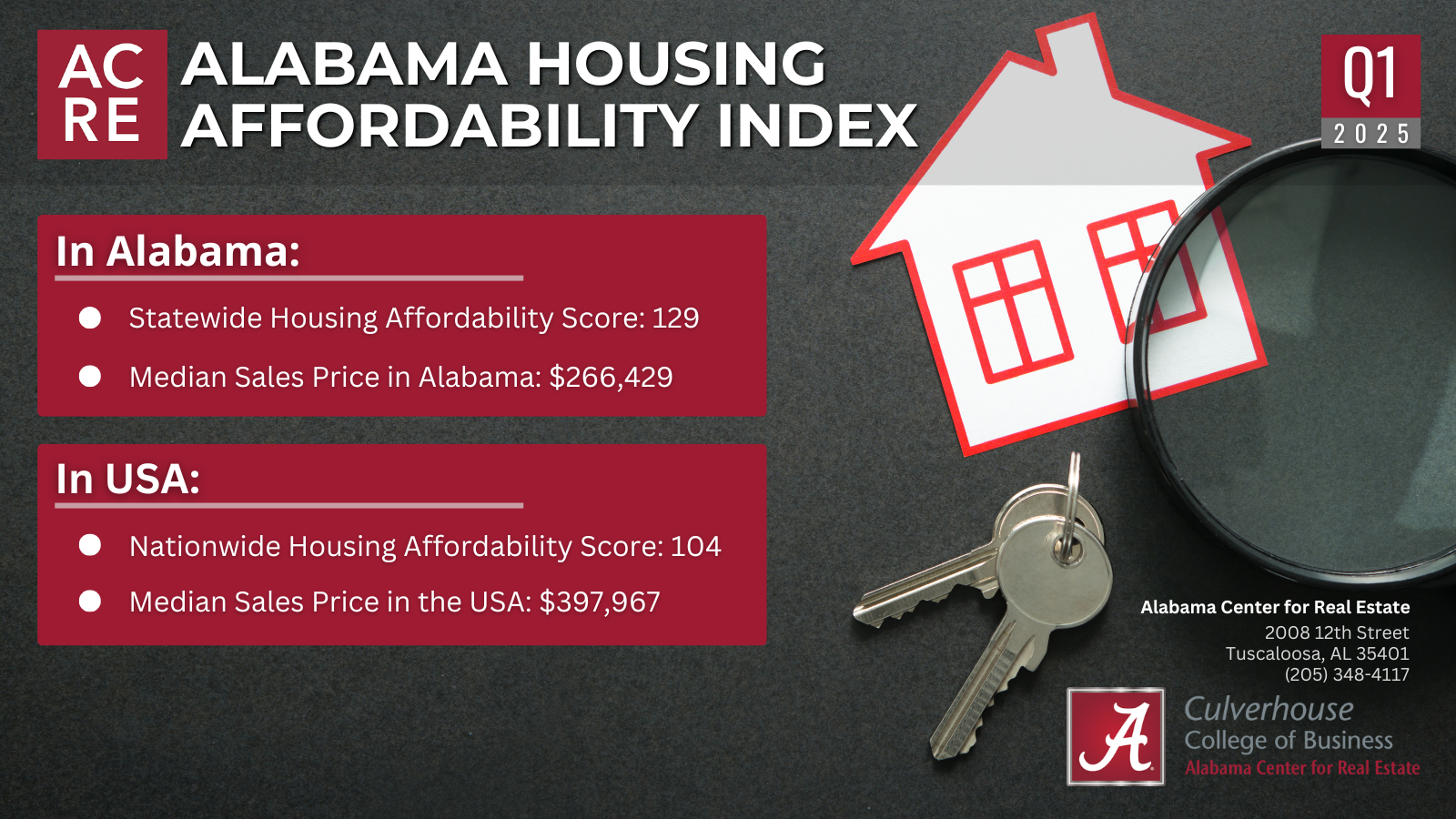

Statewide Affordability Snapshot: Alabama’s AHAI score for Q1 2025 was 129. This means a median-income family earning $86,400 has about 1.29 times the income needed to purchase the state’s median-priced home, which is currently $266,429. This assumes standard lending practices and a 20% down payment.

Most and Least Affordable Markets:

- Most Affordable Metro Areas:

- Decatur (AHAI: 154)

- Anniston-Oxford-Jacksonville (152)

- Gadsden (144)

- Least Affordable Metro Areas:

- Daphne-Fairhope-Foley (104)

- Auburn-Opelika (102)

The AHAI is calculated as the ratio of a region’s actual median family income to the income required to buy and finance the median-priced home. A score of 100 indicates a family earning the median income has just enough purchasing power to afford such a home. A higher score indicates greater affordability.

The index is based on data from Freddie Mac’s Primary Mortgage Market Survey, which recorded an average interest rate of 6.82% for Q1 2025.

About The University of Alabama: As the state’s flagship university, The University of Alabama (UA) leads in research, education, and service. With nearly 200 academic programs and more than 30 research centers, UA fosters innovation and drives economic growth throughout Alabama and beyond. The university is part of The University of Alabama System and is recognized globally for its commitment to excellence and inclusivity.