Every year, home buyers face new challenges when it comes to entering the market.

This year will be no exception, with rising mortgage rates and decreasing inventory beginning to weigh on the market.

Realtor.com recently conducted a survey which reveals the top four obstacles for home buyers this year, many of which could affect Alabama home buyers.

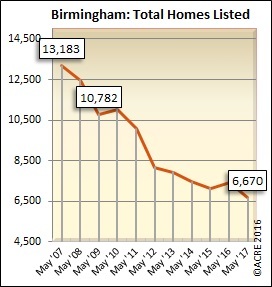

Low Inventory: According to Realtor Mag there aren’t many homes for sale, and the number of homes are expected to decrease this year. “Active inventory in 2016 on realtor.com dropped 11 percent compared to a year ago,” according to Realtor Mag.

Because of this, the housing market has started off 2017 with the lowest housing inventory since the recession and perhaps in decades.

So how is low home inventory affecting the market?

The chart above shows Alabama’s housing inventory dropped 8 percent from 2015 to 2016 and is 29 percent below the statewide peak of 41,367 in 2008.

Click here for the Alabama Center for Real Estate’s 2016 Statewide Annual Housing Report

Faith Harper, President of Birmingham Association of Realtors and a Realtor at RealtySouth, reveals the effect a low housing inventory has on the market.

“Inventory, according to the National Association of Realtors, across the nation is shrinking, trending in the wrong direction,” Harper said. “Many communities in the greater Birmingham area are experiencing this depletion of homes. As a result, when homes do appear on the market, buyers rush in for a chance to get in on the action, only to be caught in a bidding war sometimes with multiple bidders.”

Harper said she had a listing of a three-bedroom and two-bathroom home in Gardendale, a suburb of Birmingham, for $174,900. Harper received the listing at night, and within the same hour of receiving it an agent asked to show the home the following morning. By the next day there were seven more showings planned.

Regarding this kind of market, she explains “buyers with a relaxed sense of urgency will likely remain in their current residences, as this market calls for a little more tenacity to identify and act upon homes of choice.”

Harper believes there will always be a demand for homes, which will lead to the creation of new homes, something that could positively affect the current inventory trend.

Furthermore, she gives several examples of demand, such as “a retiring boomer seeking [a] second home, the rise of new household formations [and] families caring for aging family members.”

“There is plenty of opportunity for demand to remain and even increase,” Harper said. “And where there’s demand, there’s a capitalist waiting to profit.”

If inventory continues to decrease, Harper said this could have multiple affects on the housing market.

“If by some stretch inventory does decrease, in my mind rents would tend to rise,” she said. “Folks have to live somewhere. I imagine multi-family developments would increase and lenders would construct creative financing tools to meet the need.”

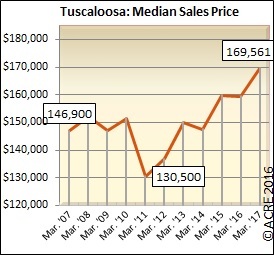

Record High Home Prices: Realtor Mag states housing prices typically decrease in the fall, but this year, the median price was $250,000 for December 2016. This is the highest price for December, and this is a 9 percent year-over-year increase nationwide.

The chart above shows Alabama’s median sales price for 2016 was $141,442, a 6 percent rise from $133,991 in 2015. This represents a new peak for Alabama home prices, which previously topped out at $130,269 in 2007.

Click here for the ACRE’s full Statewide Residential article at Alabama Newscenter

Rising Mortgages Rates. According to Realtor Mag, people who have purchased before, or “experienced buyers,” are motivated by increasing rates to buy a home before rates rise any higher.

According to realtor.com “average listing views surged 40 to 80 percent in the last three weeks of December 2016 compared to December 2015.” In addition, this demand is coming mostly from repeat buyers. However, rising mortgage rates are causing first time home buyers not to buy a home.

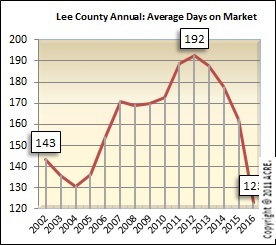

The chart above shows the average days on the market for a home in Alabama during 2016 was 142, 4.2 percent faster than 2015’s 149. This is also 10.5 percent faster than the 2012 peak of 159 days on the market.

Higher interest rates are also connected with rising mortgage rates.

“Rising interest rates mean housing payments will increase [and] as housing payments increase, the amount of borrowers that could qualify at a certain price point decrease,” said Brad Moore, mortgage loan officer at BancorpSouth in Tuscaloosa. “Also, a side effect, as rates rise so does borrowers hesitation towards purchasing.”

First Timers VS. Repeat Buyers. The amount of first time buyers who planned to buy a home this spring has decreased due to rising mortgage rates, according to Realtor Mag.

The average 30 year mortgage had increased to over 4.2 percent by the end of December 2016.

“That means a median-priced home financed with a 20 percent down would cost an extra $720 per year in added interest,” according to realtor.com’s study.

Johnathan Smoke, chief economist at realtor.com, said that “first time buyers are really dependent on financing, and affordability is one of their largest barriers to home ownership. This number could continue to decline with anticipated increases in interest rates and home prices.”

Moreover, the study from realtor.com notes first time buyers are “five times more likely than repeat buyers to say they are facing challenges qualifying for a mortgage.”

This makes affordability was their top concern for would-be buyers.

According to the NAR, first time buyers made up 32 percent of the market share in November 2016.

Smoke explains that, last fall, there was an increase of people wanting to buy a home for the first time.

However, he says the drop of first-time buyers shows their dependency on financing and affordability. Furthermore, an increase in home prices and interest rates could continue the decline of first time home buyers.

Unlike first-timers, repeat buyers are purchasing now regardless of overall increasing mortgage rates, because they understand rates are “still at historical lows.” And, according to the study, they want to buy before rates become too high.