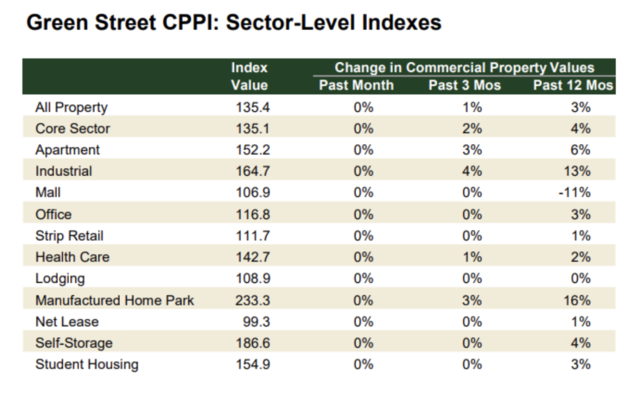

The Green Street Commercial Property Price Index* (CPPI) was unchanged in December versus November, but increased 2.5% for the calendar year 2019. The all property** index is up 1.1% over the past 3 month. The core sector index, which is calculated based on an equal weighting of apartment, industrial, office, and retail, was also unchanged from November and up 2% from the past 3 months, while it gained 4% during the last 12 months.

K.C. Conway, ACRE’s director of research and corporate engagement commented that “The flat reading in December was due to the uncertainty of trade agreements, the impeachment inquiry, and the Fed staying neutral with interest rates. The Gold, Silver, and Bronze awards again in 2019 went to manufactured housing (up 16% Y/Y), industrial (up 13%) with another year of double digit gains, and multifamily (up 6%) despite rising construction costs, a post financial crisis high in starts and permits, and fears of overbuilding.”

“At the beginning of the year, it looked like 2019 might spell the end of the decade-long run of property price increases,” said Peter Rothemund, Managing Director at Green Street Advisors. “But as the market’s worries subsided – the economy held up, the Fed went from raising rates to cutting, and a trade detente set in – commercial properties prices rose modestly. With interest rates near record lows and risk appetites back to normal levels, pricing should continue to see support in 2020.”

With a December reading of 106.9, the mall index is down 11% over the last 12 months, making it the only property type in the Green Street Index that’s down on the year. Lodging is also underperforming as its current reading of 108.9 is equal to one year ago. Other sectors with little growth over the last 12 months include strip retail and net lease (each 1%).

Manufactured home parks are currently the best performing commercial property type during the last year. The index score of 233.3 represents 16% growth. Other strong performing sectors include industrial (13%), apartment (6%), and self-storage (4%).

According to a report from Marcus & Millichap, a shortage of affordable housing units is causing increased demand for manufactured home parks. Apartment vacancy rates have declined over the last 12 months in all regions of the nation, leading to a general rise in rents. This trend is expected to continue in the quarters ahead as as construction of new affordable housing units is not expected to keep pace with demand, with many consumers choosing manufactured home parks as a result.

Regarding what lies ahead in 2020, Conway said “The fundamentals for all property sectors, except retail, seem in place for another year of +2% property price increases. However, that just isn’t going to be enough to cover rising construction costs. Property values and NOI are just now growing at a pace to keep up with rising construction costs. That’s good news for existing property owners, but not so good for developers. The retail story continues to be one of challenge with 9,300 store closings in 2019 – and already more than 1,100 announced in the first 2 weeks of 2020.”

—

*Indexed to 100 in August 2007 *All Property: retail (20%), office (17.5%), apartment (15%), health care (15%), industrial (10%), lodging (7.5%), net lease (5%), self-storage (5%), manufacturing home park (2.5%) student housing (2.5%)