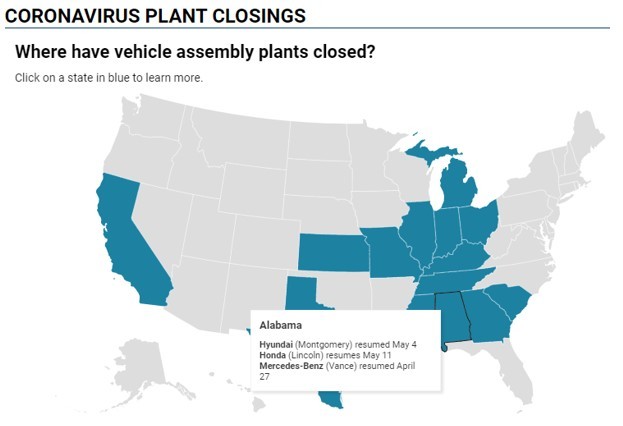

The automotive industry is material to the Alabama economy. These plants were not excluded when manufacturing facilities across the United States shut down during the coronavirus “Shelter in Place” orders. As Alabama and other states reopen their economies in a measured fashion to balance the public health risks with the fiscal risks of 22.4% (BLS) total U.S. unemployment rate for April 2020, a key industry sector to monitor is automobile sales and manufacturing. Automotive news just compiled the latest reopening data on all U.S. auto assembly plants. The good news is that nearly all plants will be reopened by the end of May. The not-so-good news is that most plants will reopen on a reduced schedule to allow more time for plant cleaning between shifts and to gauge sales/demand as consumers re-enter the workforce. What do the plant re-openings look like across the country and Alabama? The following map updated on May 7, 2020, by Automotive News shows the states in blue with plants already reopened or reopening in May. Mercedes has already resumed production in Vance, Alabama, on April 27, 2020, and Hyundai reopened on May 4, 2020. Honda in Lincoln, Alabama, plans to resume on May 11, 2020.

The states with the most auto plants and their scheduled reopening dates are as follows:

#1: Michigan with eleven plants – all planning reopening the week of May 18, 2020:

Ford Dearborn Truck Assembly resumes May 18 Ford (Flat Rock) resumes May 25

Ford Michigan Assembly (Wayne) resumes May 18

GM (Flint) resumes May 18

GM (Hamtramck) resumes May 18

GM Lansing (Delta) resumes May 18

GM Lansing (Grand River) resumes May 18

GM (Orion Twp.) resumes May 18

FCA Jefferson North (Detroit) resumes May 18

FCA (Sterling Heights) resumes May 18

FCA (Warren) resumes May 18

#2: Tie with Kentucky, Tennessee and Indiana each with 4 plants. All reopen by end of May 2020, except Volkswagen in Tennessee:

Kentucky:

Toyota (Georgetown) resumes May11

Ford Kentucky Truck (Louisville) resumes May 18

Ford (Louisville) resumes May 18

GM (Bowling Green) resumes May 18

Tennessee:

Volkswagen no date for restart

GM (Spring Hill) resumes May 18

Nissan (Smyrna) Assembly restart in June

Nissan (Decherd) resumes May 26

Another 24 plants are set to reopen by the end of May 2020 (except Nissan in Mississippi and “to be determined” Volkswagen). The plants include facilities in Alabama (3), California (Tesla – maybe), Georgia (1 – Kia), Illinois (2), Indiana (4 by Honda, Toyota, GM and Subaru), Kansas (1), Mississippi (2 including Nissan), Missouri (2), Ohio (3), South Carolina (3) and Texas (2).

While the assembly plant re-openings are welcomed news, some cold water was put on this news at the onset of this second week of May 2020 by auto makers and dealers as to the reduced demand and production plans for new autos. On May 11, 2020, Mike Jackson, CEO of the nation’s largest auto dealership chain, noted that sales fell 50% in the first half of April and another 25% the last two weeks of April. And in response to a material increase in the days of supply rising at Toyota from 77 days April 1, 2020, to 116 days May 1, 2020, Toyota is going to slow production by 29% to just 800,000 through October 2020 at its seven North American plants. That will translate to a 32% decrease from Toyota’s forecast for auto production through Q3 2020 pre-COVID-19 outbreak. This news released by Toyota on May 11, 2020, is not encouraging news for the delayed start of production at Toyota-Mazda’s new plant under construction in Huntsville, Alabama. More news like Toyota’s could follow this week as Honda announces earnings on May 12, 2020.

These are challenging times for the manufacturing sector as well as the hospitality, retail and dining industries. Alabama has material exposure to all these hard-hit job sectors. The unknown now is consumer demand. Following the May 8, 2020, jobs report and the reported total unemployment of 22.4, the questions now are how badly consumer sentiment has been damaged and if consumer spending will be curtailed for big ticket items like homes and autos. Plant re-openings are a necessary first step, but consumer demand and spending need to follow. States will likely drain their unemployment insurance trusts by July 2020 if a 20%+ unemployment rate persists. Alabama entered the COVID-19 crisis with total reserves among the 10 best states in the US (Wyoming, Oregon, Texas, West Virginia, Nebraska, South Carolina and then Alabama at 68 days). That fiscal preparedness should enable Alabama to weather this unprecedented period of unemployment and allow time for the now more than $7.0 trillion of Federal Reserve intervention and $3.0+ trillion in fiscal stimulus to take effect and bridge the states through the summer.