TUSCALOOSA, Ala. — Owning a home in Alabama became a bit tougher, according to a new study from the Alabama Center for Real Estate (ACRE).

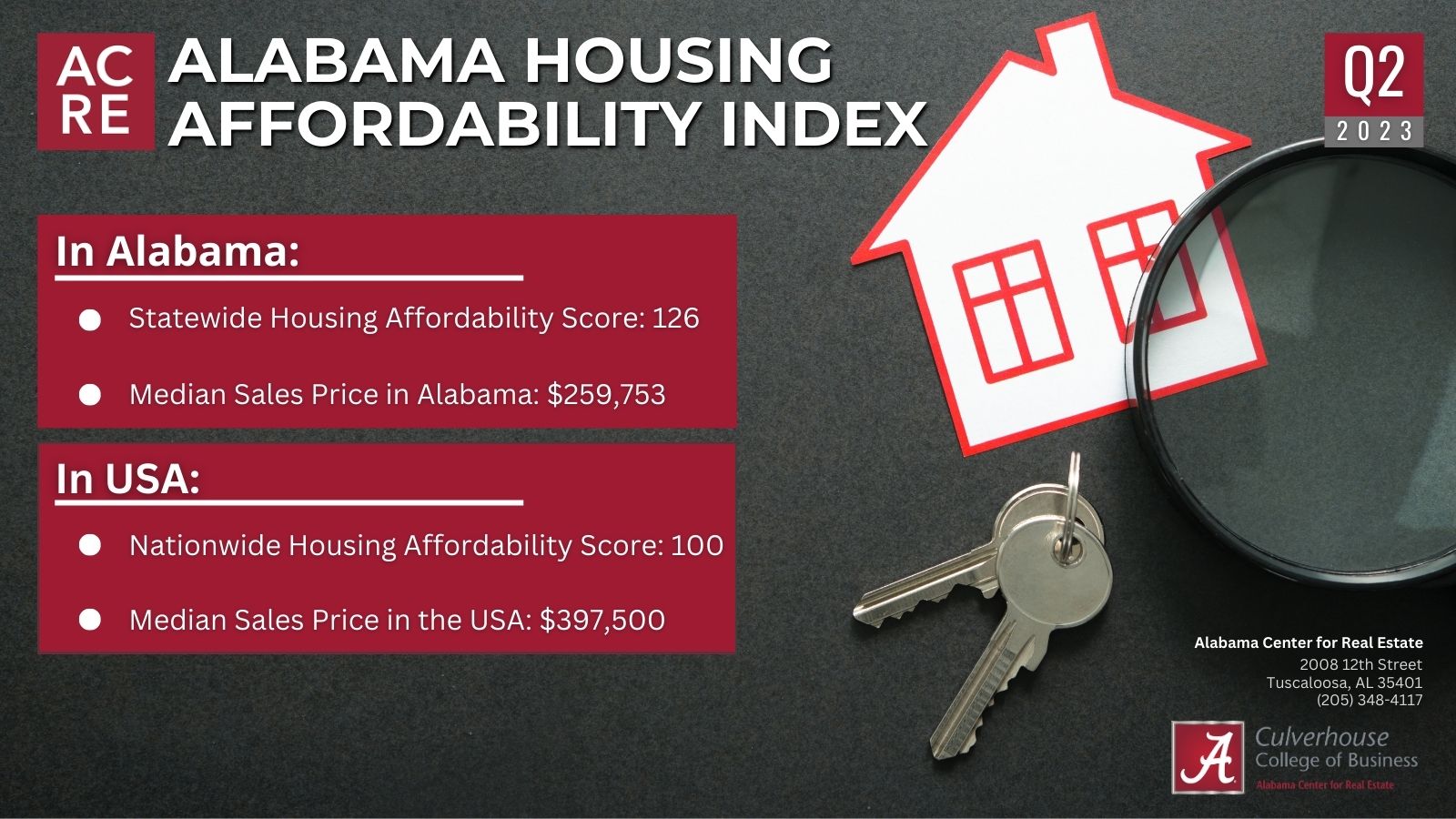

In the second quarter report of the Alabama Housing Affordability Index (AHAI™), the state recorded an affordability score of 126. The score indicates that a household earning $79,600, the median family income in Alabama, has 1.26 times the income needed to qualify for a loan to purchase a median-priced single-family home. In the Yellowhammer state, the median sales price is $259,753.

“With housing supply being limited, increasing interest rates, decreasing housing affordability, and tightening credit standards by lenders, it is creating a very complex housing market for consumers,” said Dr. Bennie Waller, the William Cary Hulsey Faculty Fellow in the UA Culverhouse College of Business and a research associate for ACRE. “Buyers, sellers and even renters are feeling it too.”

Waller said that increased interest rates coupled with a rise in housing prices have “made it very difficult for the low to middle-income buyer.”

According to the AHAI™, the composite monthly interest rate rose to 6.49% in the second quarter of 2023, a .13% increase from Q1. Compared to last year’s rates, interest rates have risen 1.25%, a $227 increase on the home’s monthly payment.

While the rate increase hurts potential buyers, Alabama remains more affordable than the national average. Although 16 of 17 areas measured had a decrease in their housing affordability index score, Auburn-Opelika and Tallapoosa County were the only markets that were underneath the nationwide affordability score of 100.

The highest affordability scores were Anniston-Oxford-Jacksonville (168), Talladega County (152), Decatur (142), Florence-Muscle Shoals (142) and Monroe County (140). Waller said the lower costs to live in these areas may not only be an indicator of opportunity zones for the industry to look into but may entice home buyers to move to those areas and commute to work.

“I think you’re going to see people driving from the Muscle Shoals area that are working in Huntsville. It’s way cheaper there or they’ll be commuting from Decatur.”

Click here for a complete look at the second quarter report.